UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

or

For the transition period from __________________________ to __________________________

Commission file number

(Exact name of registrant as specified in its charter)

| State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization | Identification No.) |

| | ||

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including

area code:

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| The | ||||

| Warrants to purchase shares of Common Stock, par value $0.0001 per share | KTTAW | The Nasdaq Capital Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405

of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ |

| Smaller reporting company | |

| Emerging growth company |

If an emerging growth company, indicate by checkmark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

No

The aggregate market value of the common stock,

par value $0.0001 per share (“Common Stock”), held by non-affiliates of the registrant as of the last business day of the

registrant’s most recently completed second fiscal quarter (June 30, 2022) was $

The registrant had

DOCUMENTS INCORPORATED BY REFERENCE

None.

PASITHEA THERAPEUTICS CORP.

2022 FORM 10-K ANNUAL REPORT

TABLE OF CONTENTS

i

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended,. These statements are generally identified by the use of such words as “may,” “could,” “should,” “would,” “believe,” “anticipate,” “forecast,” “estimate,” “expect,” “intend,” “plan,” “continue,” “outlook,” “will,” “potential” and similar statements of a future or forward-looking nature. These forward-looking statements speak only as of the date of filing this annual report with the SEC and include, without limitation, statements about the following:

| ● | our lack of operating history; | |

| ● | the expectation that we will incur significant operating losses for the foreseeable future and will need significant additional capital; | |

| ● | the period over which we estimate our existing cash and cash equivalents will be sufficient to fund our future operating expenses and capital expenditure requirements; | |

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| ● | our plans to develop and commercialize our product candidates; |

| ● | the timing of our IND submission for PAS-004; |

| ● | the timing of our planned clinical trials for PAS-004; |

| ● | the ability of our clinical trials to demonstrate safety and efficacy of our future product candidates, and other positive results; | |

| ● | disruptions to the development of our product candidates due to the continued spread of COVID-19 and the resulting global pandemic; |

| ● | the timing and focus of our future preclinical studies and clinical trials, and the reporting of data from those studies and trials; |

| ● | the size of the market opportunity for our future product candidates, including our estimates of the number of patients who suffer from the diseases we are targeting; |

| ● | the success of competing therapies that are or may become available; |

| ● | the beneficial characteristics, safety, efficacy and therapeutic effects of our future product candidates; |

| ● | our ability to obtain and maintain regulatory approval of our future product candidates; |

| ● | our plans relating to the further development of our future product candidates, including additional disease states or indications we may pursue; |

| ● | existing regulations and regulatory developments in the United States and other jurisdictions; | |

| ● | our dependence on third parties; | |

| ● | the need to hire additional personnel and our ability to attract and retain such personnel; |

| ● | our plans and ability to obtain or protect intellectual property rights, including extensions of patent terms where available and our ability to avoid infringing the intellectual property rights of others; |

| ● | our financial performance and sustaining an active trading market for our Common Stock and Warrants; and |

| ● | our ability to restructure our operations to comply with any potential future changes in government regulation. |

Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. You should refer to the “Risk Factors” section of this annual report for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. We operate in an evolving environment and new risk factors and uncertainties may emerge from time to time. It is not possible for management to predict all risk factors and uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements in this annual report will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. You should review the factors and risks and other information we describe in the reports we will file from time to time with the SEC.

ii

PART I

ITEM 1. BUSINESS

Overview

We are a biotechnology company primarily focused on the discovery, research and development of innovative treatments for Central Nervous System (“CNS”) disorders and RASopathies. We are leveraging our expertise in the fields of neuroscience, translational medicine, and drug development to advance new molecular entities that target the pathophysiology underlying such diseases, with the goal of bringing life-changing therapies to patients.

We have two business segments, “Therapeutics” and “Clinics.” Our Therapeutics segment performs activities related to discovery, research and development of innovative treatments for CNS disorders and other diseases. Our Clinics segment provided business support services to anti-depression clinics in the U.K. and in the United States. Its operations in the U.K. involved providing business support services to registered healthcare providers who assess patients and, if appropriate, administer intravenous infusions of ketamine. Its operations in the United States involved providing business support services to entities that furnish similar services to patients who personally pay for those services. Operations took place in New York, NY and Los Angeles, CA in the United States, and throughout the U.K. through partnerships with healthcare providers, including Nadelson Medical PLLC and Zen Healthcare. We did not provide professional medical services, psychiatric assessments, or administration of intravenous infusions of ketamine as part of our Clinics segment.

Prior to the date of this Annual Report on Form 10-K, we have discontinued our at-home services in New York, NY as well as our services in the U.K. In addition, we have discontinued our clinical operations in Los Angeles, CA and are actively exploring options for the disposal of related property. Accordingly, as of the date of this Annual Report on Form 10-K, we have discontinued the operations of our Clinics segment.

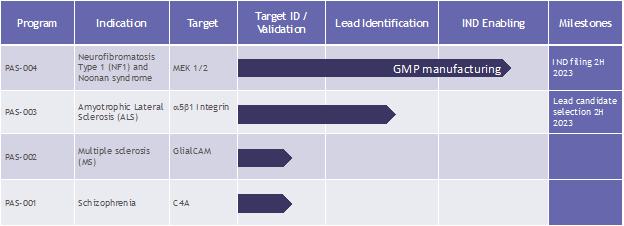

Our Therapeutic Pipeline

Our therapeutic pipeline currently consists of four programs. Our lead product candidate, PAS-004, is a next-generation macrocyclic (as defined below) mitogen-activated protein kinase, or MEK inhibitor, that we believe may address the limitations and liabilities associated with existing drugs with a similar mechanism of action. Our remaining three programs are in the discovery stage and are based on novel targets that we believe address limitations in the treatment paradigm of the indications we plan to address, which are currently amyotrophic lateral sclerosis (“ALS”), multiple sclerosis (“MS”) and schizophrenia.

1

Our Lead Program: PAS-004

Our lead therapeutic product candidate, PAS-004 (formerly known as “CIP-137401”), is a next-generation MEK 1 and 2 (“MEK 1/2”) inhibitor designed to be macrocyclic for potential use in the treatment of a range of RASopathies, including neurofibromatosis type 1 (“NF1”) and Noonan syndrome, as well as lamin A/C (“LMNA”) cardiomyopathy and a number of oncology indications. We acquired PAS-004 in connection with our acquisition of AlloMek Therapeutics, LLC (“AlloMek”), a privately held biotechnology company, in October 2022.

PAS-004 is a small molecule allosteric inhibitor of MEK 1/2. MEK 1/2 are two of several protein kinases involved in a signaling cascade, known as the mitogen-activated protein kinase, or MAPK pathway. The MAPK pathway is an important pathway in cellular biology which has been a frequent target for drug discovery efforts. The MAPK pathway has been implicated in a variety of diseases, as it functions to drive cell proliferation, differentiation, survival and a variety of other cellular functions that, when abnormally activated, are critical for the formation and progression of tumors, fibrosis and other diseases. MEK inhibitors block phosphorylation (activation) of extracellular signal-regulated kinases (“ERK”). Blocking the phosphorylation of ERK can lead to cell death and inhibition of tumor growth.

PAS-004 has been tested in a range of mouse models of various diseases and has completed preclinical testing and animal toxicology studies to support an Investigational New Drug application (an “IND”) with the U.S. Food and Drug Administration (“FDA”). Additionally, PAS-004 has received orphan-drug designation from the FDA for the treatment of NF1.

Existing FDA approved MEK inhibitors are marketed for a range of diseases, including certain cancers and NF1. We believe these MEK inhibitors suffer from certain limitations, including known toxicities. Unlike current FDA approved MEK inhibitors, PAS-004 is macrocyclic, which we believe may lead to improved pharmacokinetics, tolerability and potency. Macrocycles are large cyclic molecules that can bring increased potency, metabolic stability, and oral bioavailability. Cyclization also offers rigidity for stronger binding with drug target receptors. PAS-004 was designed to provide a longer half-life with what we believe is a better therapeutic window. Further, we believe the potency and safety profile that PAS-004 has demonstrated in preclinical studies may also lead to stronger and more durable response rates and efficacy, as well as better dosing schedules, which may not require the fasting or dietary restrictions of approved MEK inhibitors. However, the ultimate efficacy of PAS-004 cannot be known at this time and until all required clinical testing has been completed.

We plan to submit an IND to the FDA for PAS-004 in the third quarter of 2023, following completion of the ongoing good manufacturing practice (“GMP”) manufacturing of PAS-004 and finalization of our toxicology program. We plan to initially focus our clinical efforts on NF1, potentially followed by Noonan syndrome or other RASopathies, rare diseases with significant unmet clinical needs. Assuming our IND for PAS-004 is accepted by the FDA, we anticipate initiating our first-in-human Phase 1 clinical trial in healthy volunteers as early as possible after our IND is accepted.

Our Discovery Programs

In addition to PAS-004, we are developing our pipeline of discovery programs focused on novel targets for the treatment of CNS disorders that have clear unmet medical needs. Each of our discovery programs is summarized below.

PAS-003

Our PAS-003 program aims to develop a proprietary humanized monoclonal antibody (“mAb”) with a mechanism-of-action targeting a5b1 integrin for the treatment of ALS and other neuroinflammatory disorders, such as MS and possibly stroke. We believe targeting a5b1 integrin may have a beneficial impact on disease due to modulation of multiple cell types and mechanisms involved in neuroinflammation, which occurs in ALS. We acquired PAS-003 in connection with our acquisition of Alpha-5 integrin, LLC, a privately held biotechnology company, in June 2022.

PAS-002

Our PAS-002 discovery program aims to develop a proprietary engineered deoxyribonucleic acid (“DNA”) plasmid tolerizing vaccine targeting GlialCAM (a glial cell adhesion molecule implicated in neurological disease), for the treatment of MS. A published study in Nature in 2022 has shown that GlialCAM, a CNS protein found in the brain’s white matter, is attacked in MS. A component of GlialCAM mimics a component of Epstein-Barr virus (“EBV”) nuclear antigen 1 (“EBNA-1”), which has been shown to likely play a critical role in triggering MS.

2

PAS-001

Our PAS-001 discovery program aims to develop a brain penetrant small molecule targeting the complement component 4A (“C4A”) for the treatment of schizophrenia. Recent findings implicate C4A in synaptic loss (fewer connections between nerve cells), which has been shown to occur in schizophrenia. In humans, greater expression of C4A in the brain is associated with an increased risk of schizophrenia.

Our Strategy

Our mission is to develop innovative therapies to address areas of high unmet medical need, initially in CNS disorders and RASopathies. To achieve our mission, we are executing a near-term strategy with the following key elements:

| ● | Initiate clinical development of PAS-004 for the treatment of NF1. We plan to file an IND with the FDA to study PAS-004 for the treatment of NF1 by the second half of 2023 following completion of GMP manufacturing of PAS-004 and finalization of our toxicology program. Assuming our IND is accepted by the FDA, we anticipate initiating our first-in-human Phase 1 clinical trial in healthy volunteers, as soon as possible after the acceptance of our IND. Assuming we achieve positive safety data in the Phase 1 study, we plan to initiate a Phase 2 proof-of-concept clinical trial in NF1 patients as early as the second half of 2024. |

| ● | Advance PAS-004 into clinical development for Noonan Syndrome or other RASopathies. Based on results from preclinical studies, we believe that PAS-004 may have potential for the treatment of Noonan Syndrome. Following development of PAS-004 for NF1, we may pursue PAS-004 for the treatment of Noonan Syndrome or other RASopathies. As such, we will need to continue testing PAS-004 in relevant preclinical models, develop a formulation of PAS-004 that may be suitable for dosing in infants and the pediatric patient population, and perform additional IND-enabling fetal toxicology studies in non-human primates. We believe we may be eligible for a FDA priority review voucher (“PRV”) for PAS-004 for the treatment of Noonan Syndrome, for which there are currently no FDA approved therapeutics, although somatropin is approved to address the short stature associated with Noonan Syndrome. No assurances can be given that we will receive a PRV for PAS-004. |

| ● | Expand utility of PAS-004 for other indications. Based on results from preclinical studies, we believe that PAS-004 may have potential for the treatment of other diseases, such as LMNA cardiomyopathy and some cancers. We plan to test PAS-004 in various preclinical models to further demonstrate the potential utility of PAS-004 in additional indications. |

| ● | Progress our discovery pipeline to lead candidate selection. We currently plan to continue preclinical development of our discovery programs through lead candidate selection. |

| ● | Maximize the potential of our product candidates with selective use of business development and commercial collaborations. Given our limited resources, following lead candidate selection for each of our discovery programs, we plan to seek business development, non-dilutive funding and collaborative opportunities for continued preclinical and clinical development of our discovery product candidates in order to maximize potential value of each of our discovery programs. We plan to continue evaluating opportunities to work with partners that meaningfully enhance our capabilities with respect to the development and commercialization of our product candidates, which may entail the potential out-licensing of the development and commercialization of our product candidates to larger pharmaceutical organizations, including our lead product candidate PAS-004. Additionally, we plan to establish research collaborations for the continued preclinical and clinical development of our discovery programs. Further, we intend to commercialize our product candidates in key markets either alone or with partners in order to maximize the worldwide commercial potential of our programs. |

3

Overview of Our Lead Program: PAS-004

MAPK Pathway Overview

Signaling pathways describe a series of biological mechanisms in which a group of molecules work together to control a cell function. A cell receives signals from its environment when a molecule binds to a specific receptor on or in the cell. This process may be repeated multiple times through the entire signaling pathway until the last receptor is activated and the cell function is carried out. Abnormal activation of signaling pathways may lead to diseases.

The MAPK pathway, which relies upon the Ras/Raf/MEK/ERK signaling cascade, represents a central biological pathway in all human cells that is responsible for regulating cellular transcription, proliferation and survival. The general structure of the pathway consists of Ras, a small GTPase, and three downstream protein kinases, Raf, MEK and ERK. ERK 1 and 2 (“ERK 1/2”) are structurally similar protein-serine/threonine kinases that regulate a variety of cellular processes including adhesion, migration, survival, differentiation, metabolism, proliferation, transcription, cytoskeletal remodeling and cell cycle progression. MEK 1/2 catalyzes the phosphorylation of ERK 1/2, which is required for enzyme activation. Phosphorylated ERK 1/2 moves to the nucleus, and in turn activates many transcription factors, regulates gene expression, and controls various physiological processes, finally inducing cell repair or cell death.

In addition, at the level of Ras, the pathway is negatively regulated by several proteins, including neurofibromin, the protein encoded by the NF1 gene. Given its direct regulation of ERK, which directly controls downstream signaling through the MAPK pathway, MEK occupies a pivotal position in this signaling cascade and represents a rational small-molecule therapeutic target for multiple diseases, including RASopathies (such as NF1), CNS indications (such as ALS), cardiomyopathies (such as LMNA cardiomyopathy) and oncology indications, where overactivation of the MAPK pathway contributes to disease onset and/or progression.

Background of MEK Inhibitors

MAPK represents one of the most highly targeted signaling pathways in drug development. Several allosteric inhibitors of MEK 1/2 are currently in clinical development. Four of them are approved by the FDA for various oncological indications, with only one approved for NF1. These MEK inhibitors are selective towards MEK 1/2, as they bind to non-ATP-competitive allosteric sites. We believe a limitation of current FDA approved MEK inhibitors are their high rates of serious drug-related adverse events, reported to occur in many treated patients, which may result in drug intolerability. These MEK inhibitors often require increased dosing frequency, which contributes to high rates of adverse events, because the drugs systemically circulate for an extended period of time destroying healthy normal cells, which also rely on the pathway for survival.

Our rationale in developing PAS-004 is to address these shortcomings to potentially provide patients with better outcomes and improved safety.

RASopathies Overview

RASopathies are a clinically defined group of genetic syndromes caused by germline mutations in genes that encode components or regulators of the MAPK pathway. These disorders include neurofibromatosis type 1, Noonan syndrome, capillary malformation–arteriovenous malformation syndrome, Costello syndrome, cardio-facio-cutaneous syndrome, and Legius syndrome. Because of the common underlying MAPK pathway dysregulation amongst all of these syndromes, RASopathies exhibit numerous overlapping phenotypic features, including CNS abnormalities. The MAPK pathway plays an essential role in regulating various cell cycle functions, which are critical to normal human development. MAPK pathway dysregulation has profound deleterious effects on both embryonic and later stages of development, which may cause many of the RASopathies. Therefore, we believe there is a strong scientific rationale for targeting the MAPK pathway with small-molecule therapeutics to treat various RASopathies.

4

Neurofibramtosis-1 (NF-1) Overview

The initial indication we plan to pursue for PAS-004 is the treatment of NF1. NF1 is a RASopathy and part of a group of conditions known as neurocutaneous disorders, conditions that affect the skin and the CNS. NF1 is one of the most common inherited neurological disorders, affecting both children and adults. NF1 affects approximately one in 3,000 newborns throughout the world, with approximately 100,000 patients living in U.S. with NF1. NF1 arises from mutations in the NF1 gene, which encodes for neurofibromin, a key negative regulator of the MAPK pathway.

NF1 is characterized by multiple café au lait (light brown) skin spots and neurofibromas (small benign growths) on or under the skin, and/or freckling in the armpits or groin. Individuals with NF1 may have other manifestations of the disorder, including cardiac malformations, cardiovascular disease, vasculopathy, hypertension, vitamin D deficiency, brain malformations, and seizures. About 50% of people with NF1 also have learning disabilities. Softening and curving of bones, and curvature of the spine (scoliosis) may occur in some patients with NF1. Occasionally, tumors may develop in the brain, on cranial nerves, or on the spinal cord. NF1 is usually diagnosed during childhood. Throughout their lifetime, about 30% to 50% of NF1 patients progress to develop plexiform neurofibromas (“PN”), which are tumors that grow in an infiltrative pattern along the peripheral nerve sheath and can cause severe disfigurement, pain and functional impairment. In some cases NF1-PN may be fatal. NF1-PN are most often diagnosed within the first twenty years of life. These tumors are characterized by aggressive growth, which is typically more rapid during childhood. While NF1-PN are initially benign, these tumors can undergo malignant transformation, leading to malignant peripheral nerve sheath tumors (“MPNST”). NF1 patients have an 8% to 15% lifetime risk of developing MPNST, a diagnosis that carries a 12-month survival rate of under 50%. In addition to MPNST, NF1 patients are at an increased risk of developing other malignancies, including breast cancer and gliomas.

Most patients with NF1-PN are treated with surgical removal of the tumors. However, because NF1-PN arise from nerve cells and grow in an infiltrative pattern, it is challenging to successfully resect tumors without severe comorbidities, such as permanent nerve damage and disfigurement. Patients that are ineligible for surgery or those who have had a recurrence post-surgery are often treated with a variety of off-label therapies. Among these off-label therapies are various systemic treatments, such as chemotherapy and immunotherapy, which have not been shown to consistently confer a clinical benefit. Given that NF1-PN is driven by dysregulation in the MAPK pathway, MEK inhibitors have emerged as a class of therapies that may hold significant promise for the treatment of NF1.

Limitations of Current Standard of Care

Koselugo (selumetinib), a MEK inhibitor, was approved by the FDA in 2020 for NF1 pediatric patients two years of age and older who have symptomatic, inoperable plexiform neurofibromas. Koselugo is the only FDA approved drug for the treatment of NF1. Koselugo is also being evaluated in an ongoing Phase 3 clinical trial for the treatment of adult patients with NF1 who have symptomatic, inoperable PN. In addition to Koselugo, we are aware of several other MEK inhibitors in clinical trials for this indication, as well as the off-label use of other drugs, such as bevacizumab, for the treatment of NF1.

We believe that Koselugo and other earlier generation MEK inhibitors approved for indications other than NFI suffer from limitations, such as an onerous dosing schedule, which requires dosing twice a day on an empty stomach, at least one hour before or two hours after a meal. We believe that this creates a significant market opportunity for a next-generation MEK inhibitor that addresses these shortcomings, has a pharmacokinetic and tolerability profile suitable for long-term dosing and that can arrest or reverse tumor growth.

Noonan Syndrome Overview

The second indication for which we may pursue for PAS-004 is for the treatment of Noonan Syndrome. Noonan Syndrome is a genetic disorder that may be caused by variants in one of several MAPK pathway genes. It affects approximately one in 1,000 to 2,500 newborns. Noonan Syndrome is characterized by distinctive craniofacial features, including a broad forehead, hypertelorism, down-slanting palpebral fissures, and low-set, posteriorly rotated ears. Other features include congenital cardiac defects, reduced growth, bleeding disorders, and a variable degree of neurocognitive delay. Several genes have been shown to be associated with Noonan Syndrome and all these genes encode various components of or proteins associated with the MAPK pathway. Patients with Noonan Syndrome have an increased risk of developing cardiomyopathies as well as several cancers that affect the blood (leukemia), nervous system (neuroblastoma), brain (glioma), muscle (rhabdomyosarcoma), and bones. Patients with Noonan syndrome diagnosed in early childhood with severe hypertrophic cardiomyopathy have an increased mortality risk. Case reports of off label use of MEK inhibitors have shown the potential for prompt clinical improvement and subsequent amelioration of hypertrophic cardiomyopathy as assessed by ultrasound.

5

Limitations of Current Standard of Care

Noonan Syndrome can be diagnosed based on a patient’s medical history and diagnostic tests. There is no approved single treatment for Noonan Syndrome, however management of Noonan syndrome is targeted toward symptomatic improvement and supportive care depending on type and severity. Treatments typically begin around four or five years of age and continue until the child stops growing. There has been evidence of off label use of MEK inhibitors to delay time to a heart transplant in infants diagnosed with Noonan Syndrome.

Preclinical Profile and Mechanism of Action of PAS-004

PAS-004 is a next-generation MEK inhibitor that was rationally designed to have a macrocyclic structure by taking into consideration the metabolic liabilities of earlier generation MEK inhibitors. The structure of PAS-004 is distinct from other earlier generation MEK inhibitors as it maintains critical protein/ligand contacts through sulfonamide and iodophenyl but does not possess a primary alcohol or hydroxamate functionality, a known metabolic liability in earlier generation MEK inhibitors. It is generally observed that macrocyclic scaffolds improve drug-like properties including target binding, selectivity, and oral bioavailability.

PAS-004 has displayed promising pharmacokinetic properties in IND-enabling toxicology studies of both rats and dogs. In these toxicology studies, PAS-004 has demonstrated a half-life of 11.5 hours in rats and 52 hours in dogs. We believe PAS-004’s half-life allows durable suppression of ERK phosphorylation, critical for clinical responses. Further, in these toxicology studies PAS-004 displayed a low peak/trough ratio, which might minimize potential related toxicities.

Preclinical Studies Overview

In vitro Preclinical Studies of PAS-004

In an unpublished preclinical study, the effects of PAS-004 were assessed in the in vivo Colo-205 xenograft tumor model, a common mouse model used for preclinical therapies. Results showed that PAS-004 dosed at 5mg/kg once daily reduced tumor volume. The magnitude of tumor volume reduction was similar to selumetinib dosed at 25mg/kg, twice daily, as published in Molecular Cancer Therapeutics in 2007.

In an unpublished preclinical study, the effects of PAS-004 were compared to selumetinib in human wild type and NF1 deficient Schwann cells, the tumorigenic cell of origin for NF1 plexiform neurofibromas. Preliminary results showed that PAS-004 had minimal activity against wild type cells, however, dose-dependent inhibitory activity against proliferation in NF1 deficient cells was observed.

Additionally, PAS-004 was compared to selumetinib in an in vitro potency assay. Western blots from this unpublished preclinical study showed that cells treated with PAS-004 demonstrated greater reduction in ERK 1/2 phosphorylation as compared to cells treated with selumetinib.

We believe these in vitro preclinical results support PAS-004’s favorable pharmacokinetic profile, potency and dose-dependent inhibitory activity against cellular proliferation in NF1 deficient Schwann cells and appears similar to selumetinib, an FDA approved MEK inhibitor.

In vivo Preclinical Studies

In an unpublished preclinical pilot study, PAS-004 was tested for tolerability and preliminary biological efficacy in a genetically engineered mouse model of NF1 plexiform neurofibromas. These mice were engineered to develop plexiform neurofibromas that closely phenocopy the human tumors by four months of age with 100% penetrance. In this pilot study, selumetinib was administered in a parallel group, which served as a positive control. Both PAS-004 and selumetinib were administered as single-agents to six mice per group. PAS-004 was administered at 10mg/kg once daily and selumetinib was administered at the established maximum tolerated dose of 10mg/kg, twice daily. Treatment began when the mice reached four months of age and was continued for 12 weeks or until death. Mice were monitored for signs of toxicity, as well as survival. Results demonstrated that both PAS-004 and selumetinib showed similar toxicity profiles and both PAS-004 (p=0.0123) and selumetinib (p=0.0048) significantly reduced the tumor size compared to vehicle-treated mice based on statistical analysis using uncorrected Fisher’s least significant difference.

6

We believe the results from this preclinical pilot study show that PAS-004 may be effective in reducing tumor burden of NF1-associated plexiform neurofibromas. When administered at 10mg/kg once daily, PAS-004 and selumetinib, which was dosed at 10mg/kg twice daily, demonstrated similar results. We believe that the longer half-life of PAS-004, as compared to selumetinib, could potentially enhance treatment with superior efficacy by allowing better sustained MEK/ERK signaling inhibition, or allowing for greater intervals between dosing such as single daily dose as compared to the required twice daily dosing for selumetinib.

Mutations in the LMNA gene, which encodes nuclear lamins A and C, cause diseases affecting various organs, including the heart. Studies have found that the ERK 1/2 kinase branches of the MAPK signaling pathway were abnormally hyperactivated prior to the onset of significant cardiac impairment.

PAS-004 was studied in the LMNA-cardiomyopathy LmnaH222P/H222P mouse model, a validated model of cardiomyopathy caused by LMNA mutations in humans. In this study, male mice were orally administered placebo, or PAS-004 at 3 mg/kg/day or PAS-004 at 6 mg/kg/day starting at 14 weeks of age when symptoms of cardiomyopathy were present. Results of this preclinical study were published in Bioorganic & Medicinal Chemistry in 2017 and are summarized as follows:

| ● | The effects of PAS-004 on phosphorylated ERK 1/2 were studied. Following six weeks of systemic administration, both doses of PAS-004 led to significant decreases in phosphorylated ERK 1/2 relative to total ERK 1/2 in the heart and liver when compared to placebo, whereas only the 6 mg/kg/day group produced a significant decrease in phosphorylated ERK 1/2 relative to total ERK 1/2 in quadricep muscles. |

| ● | The effects of PAS-004 on echocardiographic parameters of the heart that correlate with left ventricular function were studied. Following six weeks of systemic administration, both doses of PAS-004 resulted in significant increases in left ventricular fractional shortening, the percentage the left ventricular diameter decreases with each contraction as compared to placebo. |

| ● | The effects of PAS-004 on cardiac fibrosis were studied. Following six weeks of systemic administration, both doses of PAS-004 resulted in significant decreased fibrosis based on staining with Masson trichrome of fixed sections of left ventricles, when compared to placebo. Results showed that treatment of PAS-004 lead to dose-dependent statistically significant decreases in fibrosis as scored on a histologic scale of 0 to 4 by a pathologist blind to treatment group, when compared to placebo. |

| ● | The effects of PAS-004 on survival were studied. Mice followed until death or euthanasia. 23 mice treated with placebo had a median survival of 202 days, whereas median survival was 225 days for 17 mice treated with 3 mg/kg/day of PAS-004 and 225 days for 15 mice treated with 6 mg/kg/day of PAS-004. Results showed the median survivals based on Kaplan-Meier plots of mice treated with both doses of PAS-004 were statistically significantly (P<0.05) longer than that for mice treated with placebo. |

| ● | A preliminary analysis of potential tissue toxicity of PAS-004 was performed. Following six weeks of systemic administration, serum alkaline phosphatase activity, alanine aminotransferase activity and bilirubin concentration were measured to assess possible hepatic injury and liver function. Serum creatinine and blood urea nitrogen concentrations were also measured as indicators of renal function and serum amylase activity as a marker of pancreatic injury. Results showed that there were no statistically significant differences in any of these parameters between groups. A histopathological evaluation by a pathologist blind to treatment determined there were no consistent or specific abnormalities in liver, kidney or spleen of mice receiving either doses of PAS-004 and no alterations were observed that typically occur with drug toxicity. |

7

Toxicology Studies

28-day toxicological studies were performed in both rats and dogs under good laboratory practices (“GLP”) on PAS-004 by Wuxi AppTec (Suzhou) Co., Ltd. We believe the results from these studies have demonstrated a sufficient safety and toxicology profile of PAS-004 to support our IND filing with the FDA. We are conducting an additional 28-day toxicological study in male rats to further support our IND filing with the FDA.

Overview of Our Discovery Programs

PAS-003 Program

Amyotrophic Lateral Sclerosis Overview

ALS, or Lou Gehrig’s disease, is a fatal, progressive motor neuron disease that targets nerve cells in the spinal cord and brain. ALS most commonly affects people between the ages of 40 and 70, with an average age of 55 at the time of diagnosis. It affects as many as 30,000 patients in the United States, with 5,000 new cases diagnosed each year.

While approximately 10% of cases are hereditary, which is known as familial ALS, the large majority of cases (90-95%) are not, which is known as sporadic ALS. A large majority of familial ALS cases are due to genetic mutations in the superoxide dismutase 1 (“SOD1”) gene. While the pathogenesis of ALS is not fully understood, studies have shown that the disease is multifactorial, with several interlinked mechanisms contributing to neurodegeneration, including neuroinflammation, which has been shown to play an important role in neurodegeneration.

ALS often begins with muscle twitching and/or weakness in a limb, however, as the disease progresses, ALS affects control of the muscles needed to move, speak, eat and breathe. As a result, ALS patients develop extensive muscle wasting and atrophy leading to paralysis. The life expectancy is low, with patients living on average three to five years after symptom onset, and the patient´s quality of life is typically poor.

There are currently six FDA approved medications to treat ALS and its symptoms. However, they have been shown to only modestly slow disease progression. Therefore, despite these therapies, the medical need for new treatments for ALS patients is very high.

Scientific Background and Rationale for Targeting a5b1 integrin for the treatment of ALS

Integrins are the principal receptors used by animal cells to bind to the extracellular matrix as well as other cells. Integrins activate intracellular signaling pathways and can cooperate with other conventional signaling receptors. Integrins are involved in a wide range of biological processes including cell growth, migration, survival, and proliferation as well as cytokine activation and release. As a result, integrins play a significant role in many physiological processes, including embryogenesis, organogenesis, and tissue development, but also in pathogenic ones, including inflammation, infection, and allergic and neoplastic diseases.

Integrins are composed by two non-covalently linked alpha and beta subunits. a5b1 integrin, also known as the fibronectin receptor, is a heterodimer consisting of a5 and b1 subunits. Integrins can be broadly grouped based on ligand specificity. In this classification, integrin a5b1 falls under RGD-recognizing integrins and is known to bind fibronectin, osteopontin, fibrillin, thrombospondin, among others. a5b1 integrin has been shown to play a role in cancer, angiogenesis and in a variety of neurological disorders. a5b1 integrin is a validated drug target supported by the clinical development of anti-a5b1 mAbs by several pharmaceutical companies, including PDL Biopharma, Inc. jointly with Biogen Inc., and Pfizer, Inc., for the treatment of cancer indications.

8

In a 2018 Nature Neuroscience publication, scientists at the Steinman Laboratory at Stanford University, headed by our Chairman, Prof. Lawrence Steinman, used mass cytometry to identify an upregulation of CD49e (a5 integrin) on brain myeloid cells in the mutant SOD1-G93A mouse model of ALS and demonstrated that a5b1 integrin is upregulated on microglia in the CNS as the disease progresses. Additional preclinical studies have shown that a5 integrin is also elevated on macrophages in the periphery and suggest a role for mast cells which also express high level of a5 integrin.

In collaboration with the Mayo Clinic, we have shown a5b1 integrin positive endothelial cells are concentrated in post-mortem human brain motor neuron tracts but not in sensory regions in ALS and that a5b1 expression increases with disease progression in both mouse models of ALS and human ALS patients. Previous studies have shown that high levels of a5b1 integrin on the endothelium plays a role in angiogenesis while our results suggest a role in the blood brain barrier which regulates immune cell trafficking.

Together these findings indicate that a5b1 expression increases with disease progression in mouse models of ALS and in human ALS patients and highlight the role of a5 b1 integrin on four different cell types involved in neuroinflammation in ALS: microglia, macrophages, mast cells and endothelial cells. We believe these findings suggest that targeting a5b1 integrin may provide a treatment for ALS. In this regard, initial results from the Steinman Laboratory and our own preclinical studies have demonstrated that anti-a5b1 treatment improved motor function and increased survival in SOD transgenic mice, the most phenotypically relevant preclinical model for ALS.

We believe these preclinical results demonstrate that targeting a5b1 integrin has the potential to be a powerful new therapy that could improve ALS outcomes. Our goal is to select a lead product candidate for our PAS-003 discovery program in the second half of 2023 and seek partnerships and/or collaborators to continue development of the program.

PAS-002

Multiple Sclerosis Overview

MS is an auto-immune chronic inflammatory demyelinating disease affecting the CNS. According to the National MS Society, there are more than 2.8 million people worldwide with a diagnosis of MS. In the United States a recently completed prevalence study, funded by the National MS Society, estimated that nearly one million people over the age of 18 live with a diagnosis of MS.

Most people with MS have a relapsing-remitting disease course. They experience periods of new symptoms or relapses that develop over days or weeks and usually improve partially or completely. These relapses are followed by quiet periods of disease remission that can last months or even years. Approximately two-thirds of those with relapsing-remitting MS can eventually develop a steady progression of symptoms, with or without periods of remission, within 10 to 20 years from disease onset. This is known as secondary-progressive MS. Approximately 10% of people with MS experience a gradual onset and steady progression of signs and symptoms without any relapses, known as primary-progressive MS.

The exact cause of MS is unknown, but changes in the peripheral immune system and intrinsic CNS immune cells (such as microglia) contribute to MS pathogenesis. Acute and chronic inflammation as well as neurodegeneration occur throughout the disease course, with prominence of acute inflammation in the relapsing phase of disease. Both innate and adaptive immune responses play a role in MS. The adaptive immune response includes CD8+ cytotoxic T cells as well as CD4+ T cells, in particular Th1 cells, against myelin proteins. Furthermore, B cells also play a role by mean of antigen presentation to T cells, antibody formation and production of proinflammatory cytokines. MS lesions (focal areas of myelin damage) ultimately causes the symptoms of MS.

Recent studies have proved that Epstein-Barr virus (“EBV”), triggers MS by priming the immune system to attack the body’s own nervous system. A 2022 study published in Science analyzed EBV antibodies in serum from 801 individuals who developed MS among a cohort of more than10 million people active in the U.S. military over a 20-year period. This study showed that EBV infection was present in all but one case at the time of MS onset, and found that of 35 people who were initially EBV-negative, all but one became infected with EBV before the onset of MS. This finding provides compelling data implicating EBV as the trigger for the development of MS.

9

Scientific Background and Rationale for Targeting GLIALCAM for the treatment of MS

GlialCAM found in the brain’s white matter is attacked in MS. GlialCAM is a CNS protein that has a component that mimics a component of EBNA-1, which plays a critical role in triggering MS. This study elucidated the molecular mimicry between EBNA-1 and GlialCAM, and GlialCAM’s role in the pathogenesis of MS. It also demonstrated that targeting the adaptive immune response to EBNA-1 and GlialCAM with approaches aimed at tolerization of the autoimmune response and eradication of the EBV infection in the B lymphocyte lineage. These findings demonstrate a mechanistic link between EBV infection and the pathobiology of MS and create new pathways for the clinical treatment of multiple sclerosis.

In an initial preclinical proof-of-concept study in a mouse model of relapsing-remitting experimental autoimmune encephalomyelitis (“EAE”), the standard animal model of MS, we showed that an engineered DNA tolerizing vaccine targeting GlialCAM reduced disease severity and incidence of relapse when administered prophylactically in the EAE model. Based on these results, we are continuing to study engineered DNA plasmids in additional proof-of-concept studies and plan to publish results when complete.

In addition, we are investigating different lipid nanoparticle delivery systems for delivery of the DNA plasmid.

We believe these early results in EAE models demonstrate that developing a DNA plasmid tolerizing vaccine targeting GlialCAM has the potential to reduce disease severity and incidence in relapsing-remitting MS and possibly result in a long-term cure. Our goal is to develop the PAS-002 to lead candidate selection and seek partnerships and/or collaborators to continue development of the program.

PAS-001

Schizophrenia Overview

Schizophrenia is a chronic and disabling psychiatric illness characterized by positive psychotic symptoms, such as delusions and hallucinations, negative symptoms, such as social withdrawal and amotivation, and impairment in cognitive domains, including attention, working memory, verbal learning and executive function. According to the World Health Organization (“WHO”) schizophrenia affects approximately 24 million people, or one in 300 people worldwide. Schizophrenia has a low lifetime prevalence of about 1%, however the burden of the disease is substantial. Schizophrenia is a leading cause of adult disease burden and has been ranked 12th in the top global causes of disability for the last decade, leading to substantial healthcare and societal costs, with annual associated costs in the U.S. estimated to be more than $150 billion.

Current pharmacological treatments for schizophrenia all act on dopamine D2 receptors. Although they are effective in reducing positive symptoms, they have little effect on both cognitive and negative symptoms. Furthermore, up to 30% of patients show only partial benefit with antipsychotics and have treatment resistant schizophrenia. This highlights the need for new therapeutic strategies.

Despite extensive research the molecular etiology remains unknown. The current dopamine hypothesis postulates that excessive striatal dopamine transmission and reduced frontal dopamine stimulation underlie the pathophysiology of positive and negative symptoms, respectively. However, converging lines of genetic, epidemiological and clinical evidence indicate that inflammatory pathways are also altered in schizophrenia. More recently, a leading hypothesis proposes that synaptic terminal loss is central to the pathophysiology of schizophrenia, leading to impaired cortical function, and symptoms, including cognitive impairments.

Scientific Background and Rationale for Targeting C4A for the treatment of Schizophrenia

The complement system is a group of proteins found in blood plasma and on some cell surfaces. These proteins play an important role in protecting against infection and removing dead cells and foreign material. In the brain, the complement system plays a crucial role in immune response and in synaptic elimination during normal development and disease. There are nine major complement proteins, labeled C1 through C9. Complement protein C4 is the only complement protein that has two different isotypes encoded by two different genes: C4A and C4B.

10

Microglia are phagocytes residing in the CNS. Unlike other phagocytes, which primarily function in immunity, microglia are heavily involved in shaping and supporting brain tissue. Microglia use immune molecules, such as complement proteins, to send signals to neurons and glia, and to survey their microenvironment using dynamic processes. Microglia are key modulators of neuronal development. However, the full role they play in healthy brain development and disease remain elusive.

In studies, C4A has been shown to mark synapses for phagocytosis by microglia. Further, the C4 gene has been linked to synaptic refinement and psychiatric disorders, including schizophrenia. In humans, greater expression of C4A in the brain is associated with an increased risk of schizophrenia.

The largest genome-wide association study (GWAS) in schizophrenia in 2014 identified 128 independent associations spanning 108 conservatively defined loci that meet genome-wide significance, including the major histocompatibility complex (MHC) locus on chromosome 6, which includes the C4 gene, thus furthering the hypothesis of C4 as an important genetic risk factor in schizophrenia. These results established a link between complement-mediated synaptic pruning and dendritic spine loss in the cortex of schizophrenic patients.

Animal models of increased C4 expression show reduced levels of synaptic proteins and increased phagocytosis of synaptic terminals by microglia. Moreover, preclinical models show C4 overexpression leads to reduced neurotransmission in prefrontal cortical neurons, reduced social interaction and impaired memory, which mimic similar abnormalities seen in schizophrenia patients. Finally, excessive microglial synapse elimination has been observed in schizophrenia-derived in vitro models. Post-mortem brain analyses showed that C4 is expressed at significantly higher levels in people with schizophrenia than controls. C4 levels in cerebro-spinal fluid (“CSF”) have shown to be elevated in patients with schizophrenia relative to matched controls and correlates with CSF measurements of synapse density. C4 levels have also been found to be elevated in plasma in schizophrenia, and higher levels predict poorer outcomes in first episode patients.

Several other studies in scientific journals, including a 1997 study from Psychiatry Research, a 2016 study from Nature and a 2012 study from Revista Brasileira de Psiquiatria, have also reported increased complement gene expression, protein concentration, and overall activity in the serum or plasma of schizophrenia cases compared to controls. Further, a 2020 study published in Brain, Behavior and Immunity, found that C4 was overexpressed in the dorsolateral prefrontal cortex, parietal cortex, superior temporal gyrus and associative striatum of patients with schizophrenia and that C4 expression was not altered in the peripheral tissues of schizophrenia patients. Further, the study found lifelong C4 overexpression in the brain of schizophrenia patients. Taken together, this evidence has led to the hypothesis that schizophrenia is a neuroimmune disorder mediated by alterations in pro- and anti-inflammatory processes in the CNS.

We are currently developing a brain-penetrant small molecule able to down regulate C4A, a novel neuroinflammatory pathway, for the systemic treatment of schizophrenia. The initial development work and screening is currently being conducted by Evotec, utilizing Evotec’s integrated research and development expertise and state-of-the-art structure-based drug design techniques. Our goal is to continue screening and early development of PAS-001 and seek partnerships and/or collaborators to continue further preclinical development of the program.

Recent Acquisitions

Alpha-5 Integrin Therapeutics, LLC

On June 21, 2022, we entered into a Membership Interest Purchase Agreement (the “Alpha-5 Agreement”) with PD Joint Holdings, LLC Series 2016-A and Prof. Lawrence Steinman (the “Alpha-5 Sellers”), pursuant to which we purchased from the Alpha-5 Sellers all of the issued and outstanding equity of Alpha-5 integrin, LLC, a Delaware limited liability (“Alpha-5”). The Alpha-5 Sellers were the sole title and beneficial owners of 100% of the equity interests of Alpha-5. In consideration of the equity of Alpha-5, the Alpha-5 Sellers received (i) an aggregate of 3,260,870 shares (the “Alpha-5 Shares”) of our Common Stock, (ii) warrants to purchase 1,000,000 shares of our Common Stock at an exercise price of $1.88 per share (the “Alpha-5 Warrants”), and (iii) contingent earn-out payments of an aggregate of 2% to 4% of net sales generated from the sale of a drug currently in development by Alpha-5.

11

Prof. Lawrence Steinman, one of the Alpha-5 Sellers, is our Executive Chairman and Co-Founder of the Company, and as such is considered a related party. The terms of the Alpha-5 Agreement were approved by (i) the disinterested members of the audit committee (“Audit Committee”) of our board of directors (the “Board”) and (ii) the disinterested members the Board, under the Company’s related party transaction policy.

In connection with the Alpha-5 Agreement, each of the employees of Alpha-5 entered into employment agreements with the Company.

AlloMek Therapeutics, LLC

On October 11, 2022, we entered into a Membership Interest Purchase Agreement, dated October 11, 2022 (the “AlloMek Agreement”), by and among the Company, AlloMek Therapeutics, LLC, a Delaware limited liability company (the “AlloMek”), the persons listed on Schedule 1.1 thereto (each individually a “AlloMek Seller” and collectively, “Sellers”), and Uday Khire, not individually but in his capacity as the representative of Sellers (the “AlloMek Representative”), pursuant to which we purchased all of the issued and outstanding equity of AlloMek. The AlloMek Sellers were the sole title and beneficial owners of 100% of the equity interests of AlloMek. In consideration of the sale of the equity of AlloMek, the AlloMek Sellers received (i) an aggregate of 2,700,000 shares of our Common Stock, (ii) warrants to purchase an aggregate of 1,000,000 shares of our Common Stock (the “AlloMek Warrants”) at an exercise price of $1.88 per share, which may be exercised on a cashless basis, for a period of five years commencing on the date of issuance, (iii) a cash payment in the amount of $1.05 million, (iv) the right to certain milestone payments in an amount up to $5.0 million, and (v) the right to contingent earn-out payments ranging from 3% to 5% of net sales of the Drug (as defined in the AlloMek Agreement) depending on the amount of such net sales in the applicable measurement period.

12

Competition

The biotechnology and pharmaceutical industries are characterized by rapidly evolving technologies, intense competition, and an emphasis on proprietary product candidates. While we believe that our technology, development experience and scientific knowledge provide us with competitive advantages, we face potential competition from many different sources, including major pharmaceutical, specialty pharmaceutical, and biotechnology companies, academic institutions, governmental agencies and public and private research institutions. Any product candidates that we successfully develop and commercialize will compete with existing therapies and new therapies that may become available in the future.

Many of our competitors may have significantly greater financial resources and expertise in research and development, manufacturing, preclinical testing, conducting clinical trials, obtaining regulatory approvals, and marketing approved products than we do. Mergers and acquisitions in the pharmaceutical and biotechnology industries may result in even more resources being concentrated among a smaller number of our competitors. These competitors also compete with us in recruiting and retaining qualified scientific and management personnel and establishing clinical trial sites and patient registration for clinical trials, as well as in acquiring technologies complementary to, or necessary for, our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Moreover, potential competitors have or may have patents or other rights that conflict with patents covering our technologies.

The key competitive factors affecting the success of all our product candidates, if approved, are likely to be their efficacy, safety, side effects, convenience, price, the level of generic competition, and the availability of reimbursement from government and other third-party payors.

Our commercial opportunity could be reduced or eliminated if our competitors develop and commercialize products that are safer, more effective, have fewer or less severe side effects, are more convenient, or are less expensive than any product candidates that we may develop. Our competitors also may obtain FDA or other regulatory approval for their products more rapidly than we may obtain approval for ours, which could result in our competitors establishing a strong market position before we are able to enter the market. In addition, our ability to compete may be affected in many cases by insurers or other third-party payors seeking to encourage the use of generic products.

PAS-004

Companies with FDA approved MEK inhibitors include: GSK plc, which received FDA approval for Mekinist (trametinib), which was subsequently sold to Novartis AG; Pfizer Inc., which received FDA approval for Mektovi (binimetinib); Genentech, Inc., a member of the Roche Company, which received FDA approval for Cotellic (cobimetinib); and AstraZeneca and Merck & Co., Inc., which received FDA approval for Koselugo (selumetinib). There are other MEK inhibitors in various stages of clinical trials for multiple indications, including various cancers and NF1. Additionally, there are other FDA approved small molecule therapeutics that target the MAPK signaling pathway.

13

Intellectual Property

Our ability to obtain, maintain and enforce intellectual property protection for our products candidates, formulations, processes, methods and any other proprietary technologies, preserve our trade secrets, and operate without infringing on the proprietary rights of other parties, both in the United States and in other countries is fundamental to the long-term success of our business. Our policy is to actively seek to obtain, where appropriate, the broadest intellectual property protection possible for our current product candidates and any future product candidates, proprietary information and proprietary technology through a combination contractual arrangements and patents, both in the United States and abroad. However, patent protection may not afford us with complete protection against competitors who seek to circumvent our patents.

We also depend upon the skills, knowledge, experience and know-how of our management and research and development personnel, as well as that of our advisors, consultants and other contractors. To help protect our proprietary know-how, which is not patentable, and for inventions for which patents may be difficult to enforce, we currently rely and will in the future rely on trade secret protection and confidentiality agreements to protect our interests. To this end, we require all of our employees, consultants, advisors and other contractors to enter into confidentiality agreements that prohibit the disclosure of confidential information and, where applicable, require invention assignment agreements to us of the ideas, developments, discoveries and inventions important to our business.

We generally control access to our proprietary and confidential information through the use of internal controls that are subject to periodic review. Although we take steps to protect our proprietary information and trade secrets, third parties may independently develop substantially equivalent proprietary information and techniques or otherwise gain access to our trade secrets or disclose our technology. As a result, we may not be able to meaningfully protect our trade secrets. For further discussion of the risks relating to intellectual property, see the section titled “Risk Factors—Risks Related to Our Intellectual Property.”

Our patent portfolio includes issued and pending applications worldwide for each of our programs.

PAS-004

For PAS-004, we have issued patents titled “Novel MEK inhibitors, useful in the treatment of diseases” that have claims directed to composition of matter and methods of use, and includes granted patents in the United States, Australia, Canada, China, Germany, Spain, France, Italy, Great Britain, India and Japan, that are expected to expire in October of 2030 (without consideration of patent term adjustment (“PTA”) and patent term extension (“PTE”)).

PAS-003

For PAS-003, we have pending patent applications in three patent families. The first patent family has claims directed to monoclonal antibodies. The second patent family has claims directed to humanized monoclonal antibodies. The third patent family has claims directed to methods of treating stroke. Patents that may issue worldwide in these families will have a statutory expiration date in May of 2042 to November 2043 (without consideration of PTA and PTE).

PAS-002

For PAS-002, we have pending patent applications in two patent families that are directed to GlialCAM tolerizing therapies. Patents that may issue worldwide in these families will have a statutory expiration date in 2043 (without consideration of PTA and PTE).

Grant Agreements

FightMND Grant

In connection with the acquisition of Alpha-5, we legally assumed rights under a three-year grant agreement with FightMND, a not-for-profit Australian charity, which was entered into by Alpha-5 on September 23, 2021. FightMND supports preclinical research, development and assessment of therapeutics for Motor Neuron Disease/Amyotrophic Sclerosis. Under the grant agreement, we are entitled to reimbursements for costs incurred up to $967,010 AUD for research related to a monoclonal antibody targeting a5b1 integrin as a potential treatment for ALS.

14

Manufacturing

We contract with third parties for the manufacture of our product candidates for preclinical studies and clinical trials, and we intend to continue to do so in the future. For PAS-004, we currently work with one contract manufacturing organization (“CMO”), WuXi STA, a subsidiary of WuXi AppTec (“Wuxi”) for the manufacture of PAS-004 drug substance and plan to utilize Wuxi for the manufacture of drug product for our clinical trials. We do not own or operate, and currently have no plans to establish, any manufacturing facilities. We utilize an outside CMC consultant with pharmaceutical development and manufacturing experience who are responsible for the relationships with our CMO.

We believe that the use of contract CMOs eliminates the need to directly invest in manufacturing facilities, equipment and additional staff. Although we rely on contract manufacturers, our personnel and consultants have extensive manufacturing experience overseeing CMCs and CMOs.

As we further develop our product candidates, we expect to consider secondary or back-up manufacturers for both active pharmaceutical ingredient and drug product manufacturing. To date, our CMO has met the manufacturing requirements for our product candidates in a timely manner. We expect third-party manufacturers to be capable of providing sufficient quantities of our product candidates to meet our current needs, but we have not assessed these capabilities beyond the supply of clinical materials to date. We currently engage CMOs on a ‘‘fee for services’’ basis based on our current development plans.

Employees & Human Capital

As of December 31, 2022, we had 15 full time employees, of which seven employees were related to our Therapeutics segment and eight employees were related to our Clinics segment. None of our employees are represented by a labor union or covered by a collective bargaining agreement.

We believe that our future success will depend, in part, on our continued ability to attract, hire and retain qualified personnel. In particular, we depend on the skills, experience and performance of our senior management and research personnel. We compete for qualified personnel with other medical pharmaceutical, and healthcare companies, as well as universities and non-profit research institutions.

We provide competitive compensation and benefits programs to help meet the needs of our employees. In addition to salaries, these programs (which vary by country/region and employment classification) include incentive compensation plans, healthcare and insurance benefits, retirement investments, paid time off, and family leave, among others. We also use targeted equity-based grants with vesting conditions to facilitate retention of personnel, particularly for our key employees.

The success of our business is fundamentally connected to the well-being of our people. Accordingly, we are committed to the health and safety of our employees. In response to the COVID-19 pandemic, we implemented significant changes that we determined were in the best interest of our employees, as well as the communities in which we operate, and which comply with government regulations.

We consider our relations with our employees to be good.

Facilities

Our principal executive office is located at 1111 Lincoln Road, Suite 500, Miami Beach, FL 33139. We rent approximately 300 square feet of space, which includes our executive offices. Our research and development facility is located at 458 Carlton Court, South San Francisco, CA. We rent approximately 1,900 square feet of space, which includes our laboratory and offices.

Website

Our website is www.pasithea.com. On our website, investors can obtain, free of charge, a copy of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, our Code of Conduct and Business Ethics, including disclosure related to any amendments or waivers thereto, other reports and any amendments thereto filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934, as amended, as soon as reasonably practicable after we file such material electronically with, or furnish it to, the Securities and Exchange Commission, or the SEC. None of the information posted on our website is incorporated by reference into this Annual Report. The SEC also maintains a website at http://www.sec.gov that contains reports, proxy and information statements and other information regarding us and other companies that file materials with the SEC electronically.

Government Regulation and Drug Approval

Government authorities in the United States (including federal, state and local authorities) and in other countries, extensively regulate, among other things, the manufacturing, research and clinical development, marketing, labeling and packaging, storage, distribution, post-approval monitoring and reporting, advertising and promotion, pricing and export and import of pharmaceutical products, such as our future product candidates. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources. Moreover, failure to comply with applicable regulatory requirements may result in, among other things, warning letters, clinical holds, civil or criminal penalties, recall or seizure of products, injunction, disbarment, partial or total suspension of production or withdrawal of the product from the market. Any agency or judicial enforcement action could have a material adverse effect on us.

15

U.S. Government Regulation

In the United States, the FDA regulates drugs under the Federal Food, Drug, and Cosmetic Act (“FDCA”) and its implementing regulations. Drugs are also subject to other federal, state and local statutes and regulations. The FDA’s Center for Drug Evaluation and Research would have primary jurisdiction over the premarket development, review and approval of our future product candidates. Accordingly, we have and plan to continue to investigate our products through the IND framework and seek approval through the NDA and BLA pathways. The process required by the FDA before our product candidates may be marketed in the United States generally involves the following:

| ● | submission to the FDA of an IND which must become effective before human clinical trials may begin and must be updated annually; | |

| ● | completion of extensive preclinical laboratory tests and preclinical animal studies, all performed in accordance with the FDA’s Good Laboratory Practice regulations; | |

| ● | performance of adequate and well-controlled human clinical trials to establish the safety and efficacy of the product candidate for each proposed indication in accordance with good clinical practice (“GCP”); | |

| ● | submission to the FDA of an NDA or BLA after completion of all pivotal clinical trials; | |

| ● | a determination by the FDA within 60 days of its receipt of an NDA or BLA to file the NDA or BLA for review; | |

| ● | satisfactory completion of an FDA pre-approval inspection of the manufacturing facilities at which the active pharmaceutical ingredient (“API”), and finished drug product are produced and tested to assess compliance with good manufacturing Practices (“cGMP”) regulations; and | |

| ● | FDA review and approval of an NDA or BLA prior to any commercial marketing or sale of the drug in the United States. |

An IND is a request for authorization from the FDA to administer an investigational drug product to humans. The central focus of an IND submission is on the general investigational plan and the protocol(s) for human studies. The IND also includes results of animal studies or other human studies, as appropriate, as well as manufacturing information, analytical data and any available clinical data or literature to support the use of the investigational new drug. An IND must become effective before human clinical trials may begin. An IND will automatically become effective 30 days after receipt by the FDA, unless before that time the FDA raises concerns or questions related to the proposed clinical trials. In such a case, the IND may be placed on clinical hold and the IND sponsor and the FDA must resolve any outstanding concerns or questions before clinical trials can begin. Accordingly, submission of an IND may or may not result in the FDA allowing clinical trials to commence.

Clinical trials involve the administration of the investigational drug to human subjects under the supervision of qualified investigators in accordance with GCP, which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. Clinical trials are conducted under protocols detailing, among other things, the objectives of the study, the parameters to be used in monitoring safety, and the efficacy criteria to be evaluated. A protocol for each clinical trial and any subsequent protocol amendments must be submitted to the FDA as part of the IND. Additionally, approval must also be obtained from each clinical trial site’s institutional review board (“IRB”) before the trials may be initiated, and the IRB must monitor the study until completed. There are also requirements governing the reporting of ongoing clinical trials and clinical trial results to public registries.

16

The clinical investigation of a drug or biologic is generally divided into three phases. Although the phases are usually conducted sequentially, they may overlap or be combined. The three phases of an investigation are as follows:

| ● | Phase I. Phase I includes the initial introduction of an investigational new drug into humans. Phase I clinical trials are typically closely monitored and may be conducted in patients with the target disease or condition or in healthy volunteers. These studies are designed to evaluate the safety, dosage tolerance, metabolism and pharmacologic actions of the investigational drug in humans, the side effects associated with increasing doses, and if possible, to gain early evidence on effectiveness. During Phase I clinical trials, sufficient information about the investigational drug’s pharmacokinetics and pharmacological effects may be obtained to permit the design of well-controlled and scientifically valid Phase II clinical trials. The total number of participants included in Phase I clinical trials varies, but is generally in the range of 20 to 80. |

| ● | Phase II. Phase II includes controlled clinical trials conducted to preliminarily or further evaluate the effectiveness of the investigational drug for a particular indication(s) in patients with the disease or condition under study, to determine dosage tolerance and optimal dosage, and to identify possible adverse side effects and safety risks associated with the drug. Phase II clinical trials are typically well-controlled, closely monitored, and conducted in a limited patient population, usually involving no more than several hundred participants. |

| ● | Phase III. Phase III clinical trials are generally controlled clinical trials conducted in an expanded patient population generally at geographically dispersed clinical trial sites. They are performed after preliminary evidence suggesting effectiveness of the drug has been obtained, and are intended to further evaluate dosage, clinical effectiveness and safety, to establish the overall benefit-risk relationship of the investigational drug product, and to provide an adequate basis for product approval. Phase III clinical trials usually involve several hundred to several thousand participants. |

A pivotal study is a clinical study which adequately meets regulatory agency requirements for the evaluation of a drug candidate’s efficacy and safety such that it can be used to justify the approval of the product. Generally, pivotal studies are also Phase III studies but may be Phase II studies if the trial design provides a well-controlled and reliable assessment of clinical benefit, particularly in situations where there is an unmet medical need.

The FDA, the IRB or the clinical trial sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Additionally, some clinical trials are overseen by an independent group of qualified experts organized by the clinical trial sponsor, known as a data safety monitoring board or committee. This group provides authorization for whether or not a trial may move forward at designated check points based on access to certain data from the study. We may also suspend or terminate a clinical trial based on evolving business objectives and/or competitive climate.

Assuming successful completion of all required testing in accordance with all applicable regulatory requirements, detailed investigational drug product information is submitted to the FDA in the form of an NDA or BLA requesting approval to market the product for one or more indications. The application includes all relevant data available from pertinent preclinical and clinical trials, including negative or ambiguous results as well as positive findings, together with detailed information relating to the product’s chemistry, manufacturing, controls and proposed labeling, among other things. Data can come from company-sponsored clinical trials intended to test the safety and effectiveness of a use of a product, or from a number of alternative sources, including studies initiated by investigators. To support marketing approval, the data submitted must be sufficient in quality and quantity to establish the safety and effectiveness of the investigational drug product to the satisfaction of the FDA.

17